working capital turnover ratio class 12

Working capital turnover ratio 1850000370000. Calculate the amount of Current Assets and Current Liabilities.

Financial Ratios Balance Sheet Accountingcoach Financial Ratio Accounting And Finance Accounting

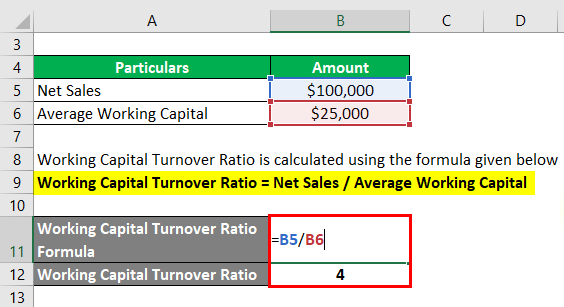

This means that for every 1 spent on the business it is providing net sales of 7.

. It reflects relationship between revenue from operations and net assets capital employed in the business. Revenue from the operation for the year were RS. 200000 and general reserve Rs.

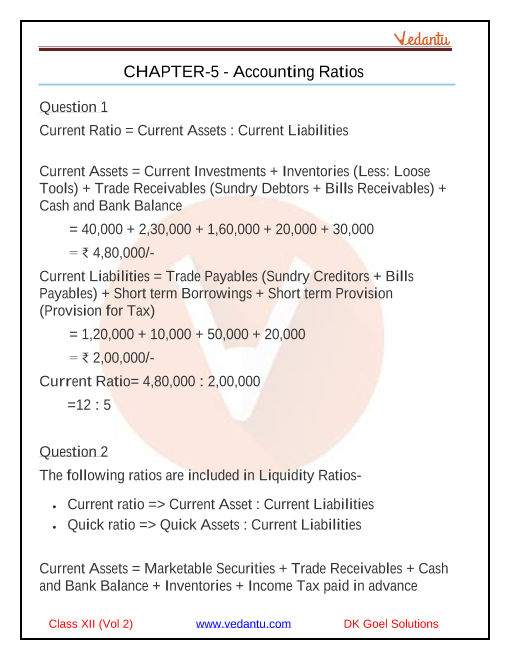

A 3 times b 5 times c 8 times d 4 times. NCERT Solutions for Class 12 Commerce Accountancy Chapter 5 Accounting Ratios are provided. Meaning of Working Capital Turnover Ratio.

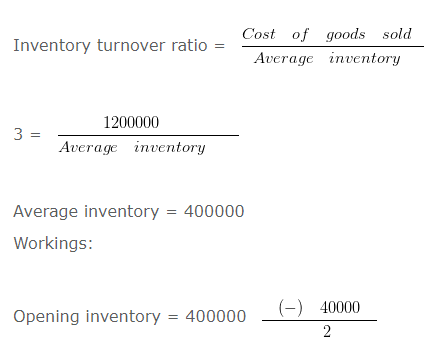

Current assets cash bank trade receivable current assets 200000 300000 50000 current assets 550000 Let cost of goods sold be 100. 700000 Working Capital Turnover Ratio 56 times So the Working Capital Turnover Ratio is 56 times. MCQ Questions for Class 12 Accounting Ratios.

500000 reserve surplus Rs. Working capital Turnover ratio Net Sales Working Capital 420000 60000 7. Interest coverage ratio is a solvency ratio.

This means that every dollar of working capital produces 6 in revenue. MCQ Of Accounting Ratios Class 12 Chapter 10 Question 3. Working capital turnover ratio 5 Times Working note 1.

From the following information calculate the working capital turnover ratio. Ans d What will be the current ratio of a company whose net working capital is Zero. Working capital turnover ratio Turnover ratio Class 12.

Working Capital is 90000. Cost of revenue from operations is 1200000. This concludes our article on the topic of Working Capital Turnover Ratio which is an important topic in Class 12 Accountancy for.

The working capital turnover ratio is thus 12000000 2000000 60. I Operating profit ratio. 60000Calculate net credit revenue from operations.

It shows the number of times a unit of Rupee invested in working capital produces sales. Its working capital turnover ratio will be. When inventory and current assets given Ratio Analysis Class 12 Example 10.

This concludes our article on the topic of Working Capital Turnover Ratio which is an important topic in Class 12 Accountancy for. The ratio of working capital turnover is determined by dividing net annual sales for the same 12-month period by the average sum of working capital current assets minus current liabilities. Trade receivable turnover ratio 5 times average trade receivables Rs.

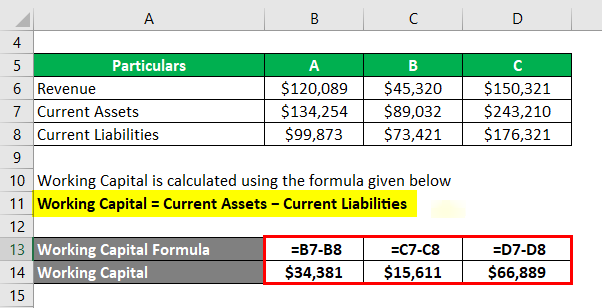

Working capital Current assets - Current liabilities Working capital 550000 - 180000. A firms current assets are 360000 current ratio is 3. The working capital turnover ratio is thus 12000000 2000000 60.

Revenue from the operation for the year were RS. Ratio It is an arithmetical expression of relationship between two related or interdependent items. 12 00000.

Or Current Assets 35 Current Liabilities 1 Working Capital Current Assets Current Liabilities. Accounting Ratios It is a mathematical expression that shows the relationship between various items or groups of items shown in financial statements. 500000 reserve surplus Rs.

When ratios are calculated on. Working Capital 90000. 1 or 25 Current Liabilities 90000.

Working capital turnover ratio 1850000370000. A 15000. B Interest coverage ratio.

Trade Payable Turnover Ratio Purchases Average Trade Payables Purchases Creditors Bills payable 420000 90000 52000 420000 142000 296 times d Working Capital Turnover Ratio. Working Capital Turnover Ratio Formula Calculator Excel Template NCERT Solutions for Class 12 Commerce Accountancy Chapter 5 Accounting Ratios are provided. I Compute debtors turnover ratio from the following information Revenue from operations Total sales Rs 520000 cash revenue from operations 60 of the credit revenue from operations closing debtors Rs 80000 opening debtors are 34th of closing debtors.

Accounting Ratios class 12 Notes Accountancy in PDF are available for free download in myCBSEguide mobile app. Working capital turnover ratio Classification of Ratios Question 12. MCQ Questions Class 12 Accountancy Accounting Ratios Question.

Working capital turnover ratiocost of revenue from operations or revenue from operations i. Working Capital turnover ratio Accounting Ratio Activity ratio class 12 Accounts video 110class 12 Accountsaccounting ratiosworking capital turnover. Working capital turnover ratio Turnover ratio Class 12 Part-12Trade Payable Turnover Ratio Class 12 Accountancy Part-11 Session 2021-22httpsy.

The best app for CBSE students now provides accounting for partnership firms fundamentals class 12 Notes latest chapter wise notes for quick preparation of CBSE board exams and school-based annual examinations. Working capital turnover ratio 5 Times. Putting the values in the formula of working capital turnover ratio we get.

We now look at the meaning and characteristics of working capital turnover ratio as mentioned in the chapter on accounting ratios class 12. If share capital Rs. Take the Next Step to Invest.

Accounting Ratios CBSE Notes for Class 12 Accountancy Topic 1. A 11 b 0 c 15 b Cant say. Say that Company A has 12 million in net sales over the previous 12 months.

It is a relationship between working capital and revenue from operations. Current Ratio 25 Quick Ratio 15 Working Capital 60000. From the following information calculate the working capital turnover ratio.

Current Ratio is 351. 100000 and total assets RS 2100000. If share capital Rs.

From the following information calculate. Revenue from the operation for the year was RS. Working capital turnover ratio 5 Times.

A Inventory turnover ratio and working capital turnover ratio b Liquid Ratio and Operating Ratio c Liquid Ratio and Current Ratio d Gross Profit Margin and Net Profit Margin. Students can refer to mcq questions for class 12 accounting ratios provided below. Which of the following is not an activity ratio.

Ans b Given that. 100000 and total assets RS 2100000. The working capital of a company is the difference between the current assets and current liabilities of a company.

Net sales Beginning working capital Ending working capital 2 Example of the Working Capital. The value of current liabilities will be. And if Working capital turnover ratio Ans.

200000 and general reserve Rs. The working capital turnover ratio is thus 12000000 2000000 60. 700000 Working Capital Turnover Ratio 56 times So the Working Capital Turnover Ratio is 56 times.

A Inventory turnover ratio B Interest coverage ratio C Working capital turnover ratio D Trade receivables turnover ratio Answer.

Financial Ratios Balance Sheet Accountingcoach Financial Ratio Accounting Education Financial Statement Analysis

Dk Goel Solutions Class 12 Accountancy Volume 2 Chapter 5 Accounting Ratios

Working Capital Turnover Ratio Meaning Formula Calculation

Important Questions For Cbse Class 12 Accountancy Classification Of Accounting Ratios

Working Capital Turnover Ratio Different Examples With Advantages

Capital Turnover Definition Formula Calculation

20 Ratios To Measure A Company S Health Financial Ratio Bookkeeping Business Financial Analysis

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratio Different Examples With Advantages

Working Capital Turnover Ratio Formula Calculator Excel Template

Dk Goel Solutions Class 12 Accountancy Chapter 5 Accounting Ratios

Working Capital Turnover Ratios Universal Cpa Review

Ratio Analysis Class 12 Notes And Examples Accountancy Arinjay Academy

Working Capital Turnover Ratios Universal Cpa Review

Rbse Solutions For Class 12 Accountancy Chapter 11 Ratio Analysis

Working Capital Turnover Ratio Different Examples With Advantages

Working Capital Turnover Ratio Different Examples With Advantages

Business Education Business Degree Business School Business Management Businesseducation Finance Investing Bookkeeping Business Accounting Basics