ad valorem tax florida ballot

Florida Department of Revenue. 40 percent of the assessed value of all other.

Jacksonville School Tax Referendum Moves One Step Closer To Ballot

Six proposed constitutional amendments will be on the ballot Nov.

. 2 2 Florida S Latest Fair Elections Imbroglio Concerns Party Names On The Ballot The Fulcrum 2020 Florida Constitutional Amendments Ballot. 30 percent of the assessed value of any homestead property eligible for additional exemption for certain seniors. Ad valorem tax florida ballot Sunday March 13 2022 Edit.

Florida Politics is a statewide new media platform covering campaigns elections government policy and lobbying in Florida. Section 1961995 Florida Statutes requires that a referendum be held if. Raises minimum wage to 1000 per hour effective September 30th 2021Each September 30th thereafter minimum wage shall increase by.

Ad Valorem Tax Discount for Spouses of Certain Deceased Veterans. 74-430 Laws of Florida provides that if the amount of ad valorem tax revenues for the proposed budget for operating funds of a governmental unit in Brevard County levying ad valorem taxes on all or part of the countys tax roll exceeds by ten percent the ad valorem tax revenues for operating funds of the preceding year. 21812 Appropriations to offset reductions in ad valorem tax revenue in.

Raising Floridas Minimum Wage What it says. Impact fees and user charges. An elected board may levy and assess ad valorem taxes on all taxable property in the district to construct operate and maintain district facilities and services to pay the principal of and interest on general obligation bonds of the district and to provide for any sinking or other funds established in connection with such bonds.

An Alachua County Ad Valorem Tax Renewal question is on the November 6 2012 election ballot in Alachua County which is in Florida where it was approved. 85-381 Laws of Florida Ch. The 2021 Florida Statutes.

1 AD VALOREM TAXES. This is the last of six on this years ballot and its full name is. Ad Valorem Tax Discount for Spouses of Certain.

This platform and all of its content are. At least 60 of voters must approve an amendment for it to pass so it is vitally important that voters understand their far-reaching consequences that will affect Floridians for generations to come. An elected board may levy and assess ad valorem taxes on all taxable property in the district to construct operate and maintain district facilities and services to pay the principal of and interest on general obligation bonds of the.

The district school board pursuant to resolution adopted at a regular meeting shall direct the county commissioners to call an election at which the electors within the school districts may approve an ad valorem tax millage as authorized in s. 101173 District millage elections. Property Tax Oversight Program.

As amended by Ch. The measure would have limited the power of local government to raise revenue from the ad valorem taxes - no county or municipality would have been allowed to levy ad valorem taxes on more than. 1 The Board of County Commissioners or.

101173 District millage elections. Home ad tax valorem wallpaper. An ad valorem tax levied by the board for operating.

Ad Valorem property tax exemptions can be granted to new and expanding businesses only after the voters of a city andor county vote in a referendum to allow that city or county to grant exemptions. This question authorized the County of Alachua to renew a property tax levy of 1 mill 1 per 1000 of assessed valuation for 4 years in order to fund school improvement and school programs in the County. 1 MILLAGE AUTHORIZED NOT TO EXCEED 2 YEARS.

In December 1999 the question of whether the city commission should be granted the authority to grant exemptions from city ad valorem taxes pursuant to Article VII section 3 Florida Constitution and section 1961995 Florida Statutes for new businesses and expansions of existing businesses was placed on the ballot1. Dade County Florida School Board to adopt a resolution seeking to place a ballot measure before the electors of Miami -Dade County asking voters to approve an ad valorem tax millage for a period not to exceed four years and to be used for operating expenses of the School Board. Article VII Finance and Taxation.

Provides that the homestead property tax discount for certain veterans with permanent combat-related disabilities carries over to such veterans surviving spouse who holds legal or beneficial title to and who permanently resides on the homestead property until he or she remarries or sells or otherwise disposes of the property. The 2021 Florida Statutes.

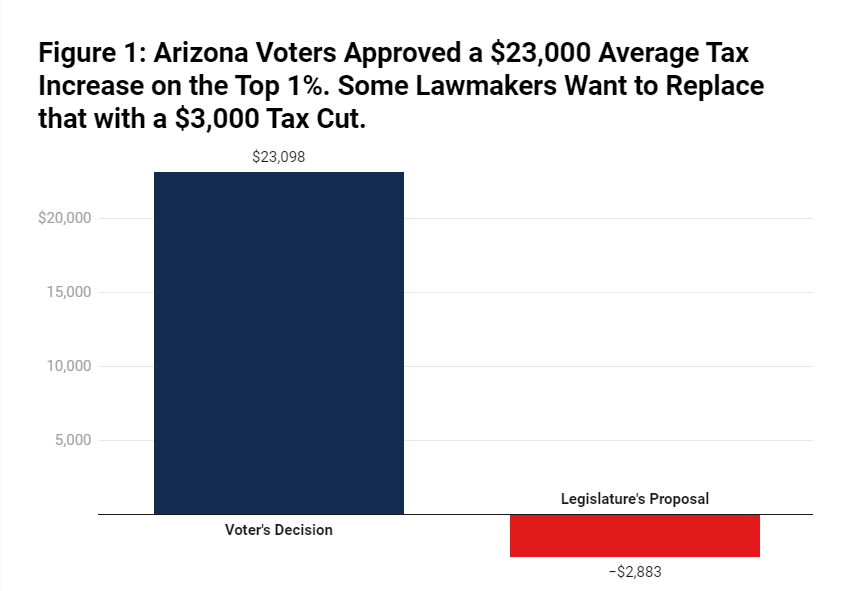

Arizonans Voted To Tax The Rich Now Lawmakers Want To Undo Most Of That Itep

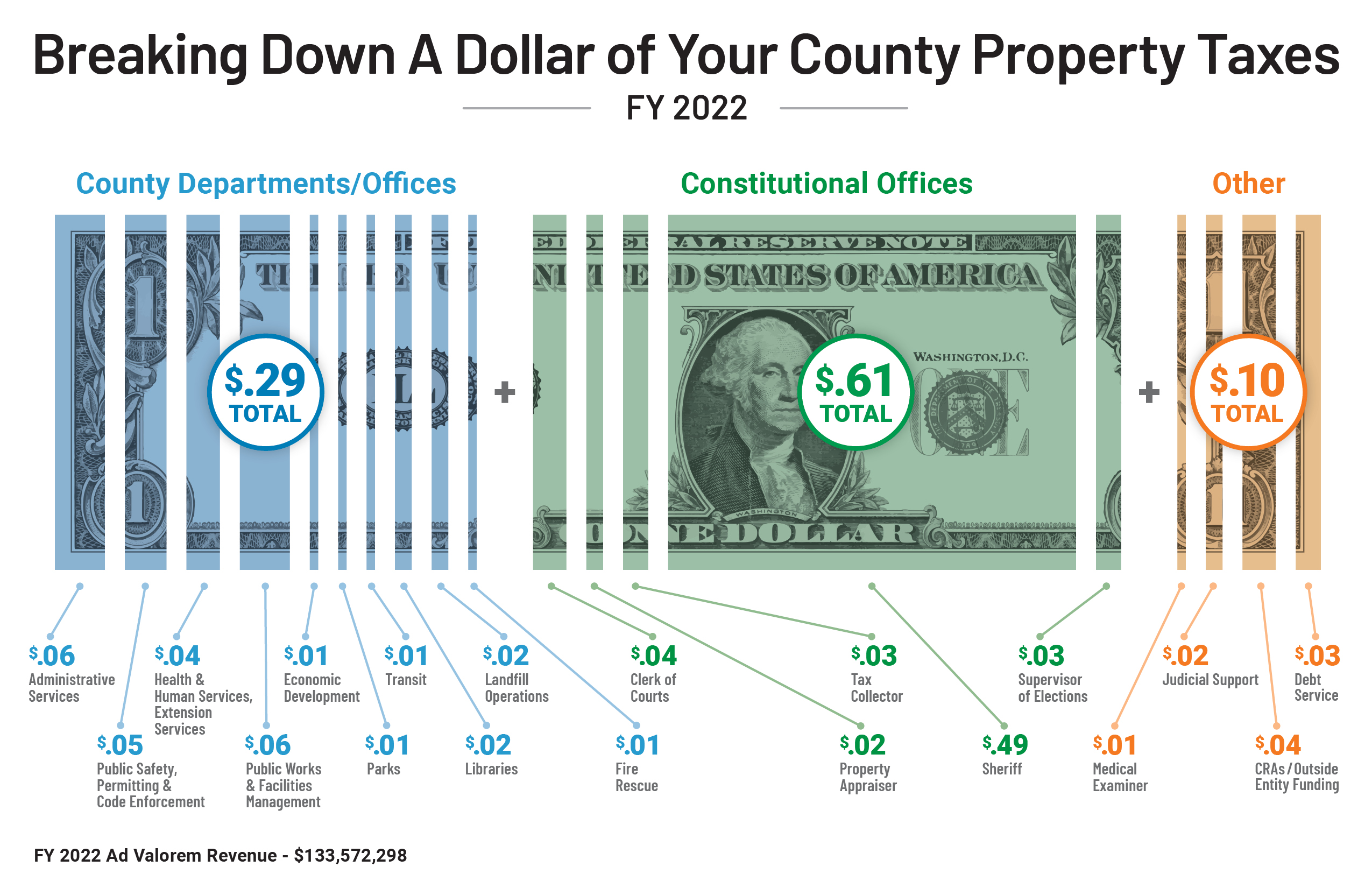

Fiscal Year 2022 Management Budget

Sales Tax Increase On The Ballot The Highlander Highlands North Carolina

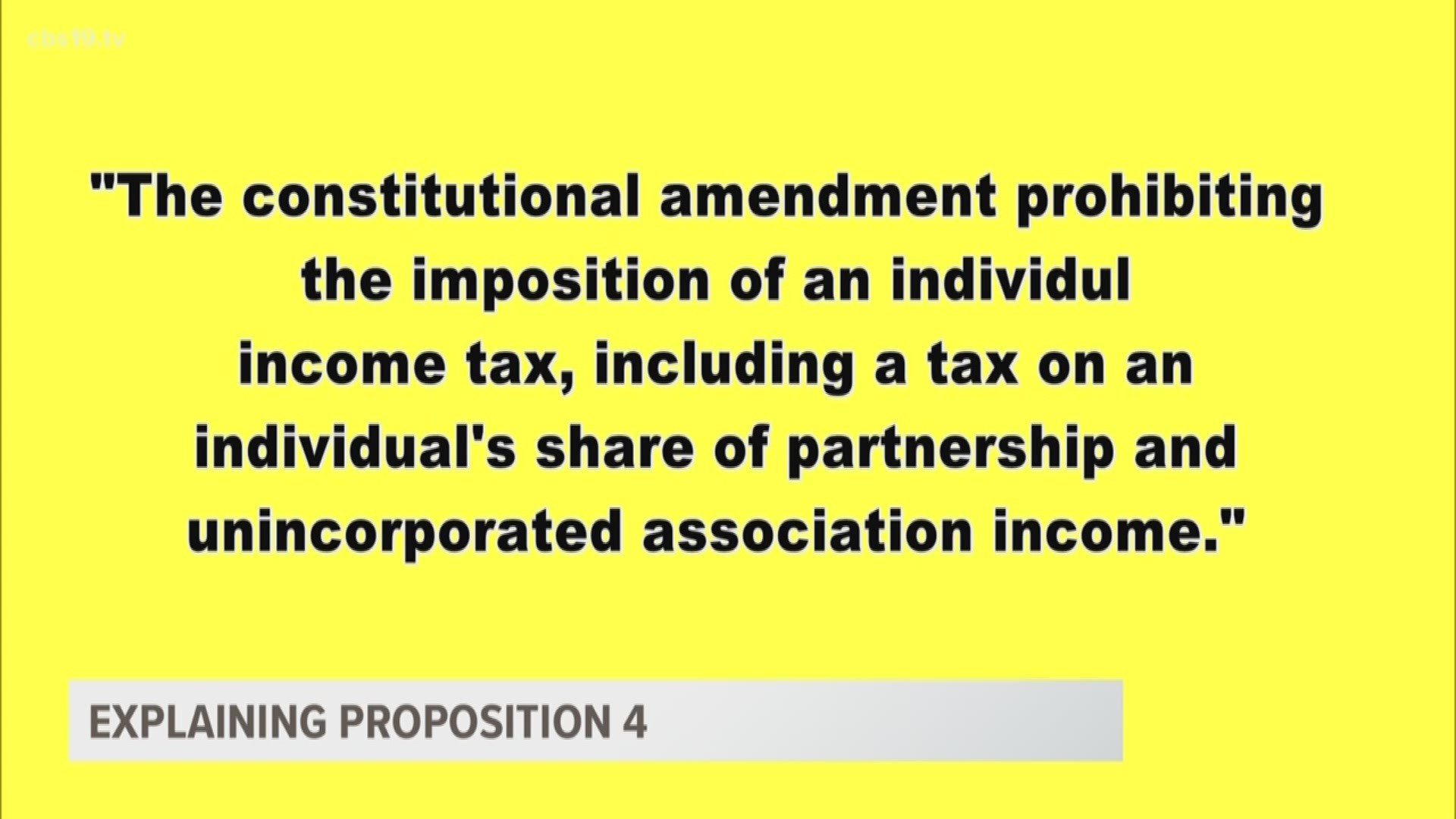

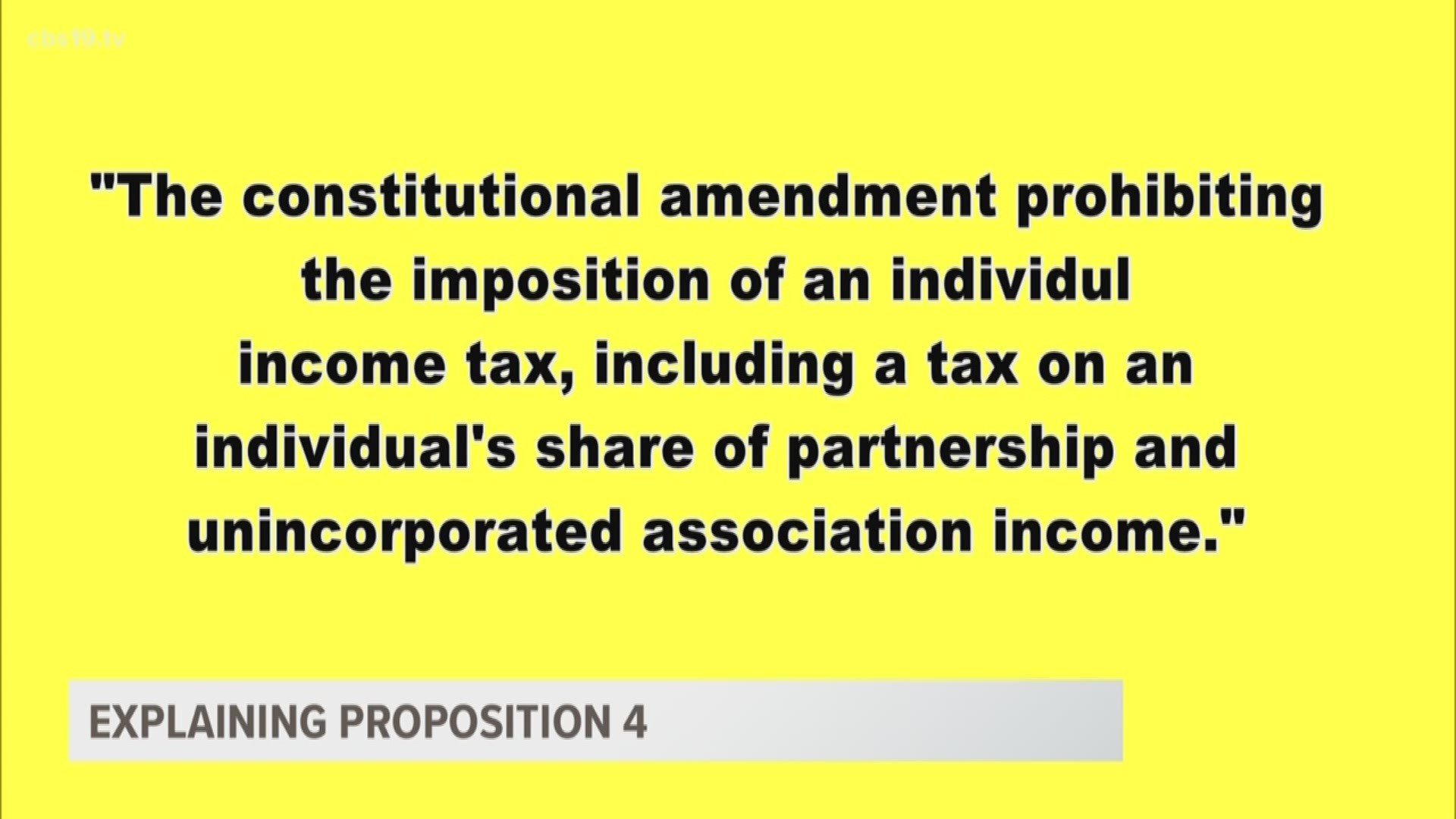

What You Need To Know Proposition 4 And State Income Tax Cbs19 Tv

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Despite Skepticism Property Tax Exemption Moves One Step Closer To Becoming Law The Capitolist

Will There Be Property Tax Proposals On The Ballot On U S Election Day Mansion Global

Florida To Vote In November On Additional Property Tax Exemption For Certain Public Service Workers Ballotpedia News

Should You Vote Yes Or No On Property Tax Measure Hawaii Business Magazine

Amendments 5 And 6 On Florida S Ballot Focus On Florida Property Taxes The Independent Florida Alligator

Duval School Board Votes 6 1 To Put Property Tax Onto August Ballot Wjct News

Understanding Inequitable Taxes On Commercial Properties And Prop 15 California Budget And Policy Center

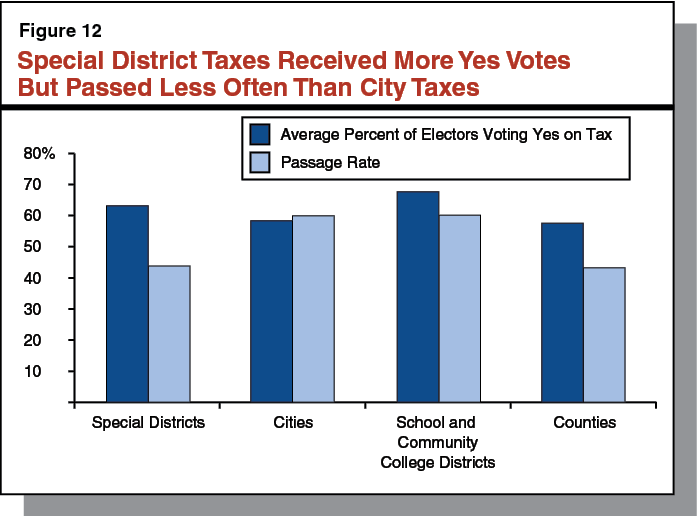

A Look At Voter Approval Requirements For Local Taxes

Understanding Your Vote Naples Florida Weekly

Bexar County Commissioners Approve Symbolic Property Tax Cut

Florida S State And Local Taxes Rank 48th For Fairness

Jacksonville Civic Council Supports School Tax Increase Jax Daily Record Jacksonville Daily Record Jacksonville Florida

Measure To Add Tax On Property Sales Over 5m Set For November Ballot